Merger control proceedings

Conducting a merger control proceeding

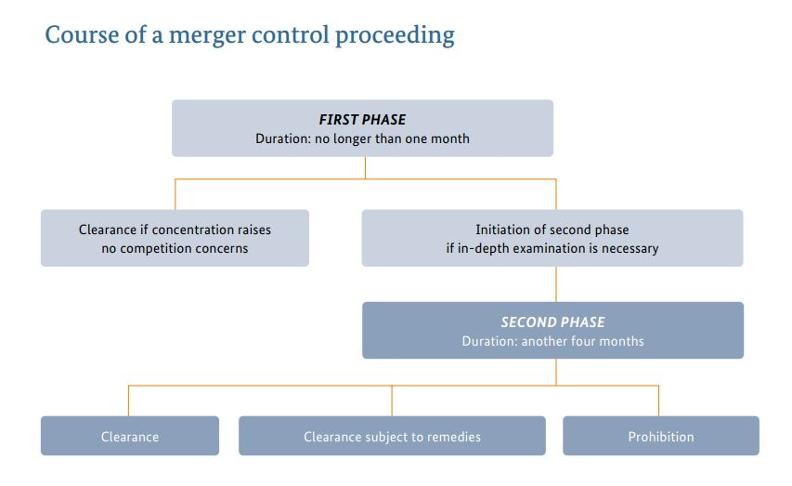

The proceeding begins once the Bundeskartellamt has received a complete notification. The authority then has one month to decide whether the merger project needs to be examined in more detail or can be cleared (so-called first phase). The vast majority of the more than 800 merger cases notified to the Bundeskartellamt every year can be cleared within the first phase of merger control.

If the project does not raise any competition concerns in the first phase of merger control, the companies involved are informed of this in an informal letter.

If there are indications that the merger may cause competition problems which cannot be resolved in the first phase or if the competent decision division believes that further investigations are necessary for other reasons, a formal in-depth investigation is initiated (“second phase”), extending the examination period to a total of up to five months from the date of notification.

The Bundeskartellamt has extensive investigatory powers, which allow the authority to obtain a comprehensive picture of the conditions under which competition takes place. It can, for example, request companies and associations of companies to provide all relevant documents and business data. It also conducts extensive market surveys on a regular basis and talks with individual market participants.

After the second phase, the proceeding is always concluded with a formal decision. The examination can either result in the Bundeskartellamt either prohibiting or clearing the merger project. A merger project can also be cleared subject to conditions and obligations (more information on how proceedings can be concluded is available below).

Criteria on which a decision is based

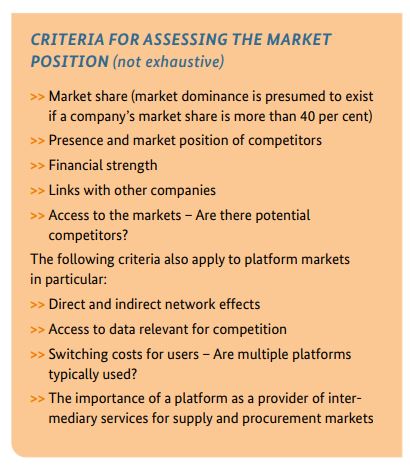

Under the German Competition Act (Gesetz gegen Wettbewerbsbeschränkungen – GWB) the Bundeskartellamt must prohibit mergers which significantly impede effective competition. This applies in particular if a merger is expected to create or strengthen a dominant position. In all other cases the merger must be cleared. This also applies in exceptional cases if the companies involved demonstrate in the course of the merger control proceeding that the merger will also improve the conditions of competition and that these improvements will outweigh the impediment to competition.

Effective competition is significantly impeded if the merger provides the companies involved with a scope of action that is no longer sufficiently controlled by competition. This would enable a company to raise its prices, lower product quality, limit innovation or otherwise reduce the quality of its offer without running the risk of losing customers.

A large number of factors are relevant in assessing the market conditions, for example the market shares of the parties involved in the merger and their competitors, the availability of resources relevant for competition (for example patents, production sites, distribution networks), barriers to market entry for newcomers, limits to the expansion of suppliers already active on the market, switching costs for customers and, if applicable, the buying power of the opposite market side.

The Bundeskartellamt has to carry out a detailed assessment of the markets affected. For this purpose the authority has to analyse a large number of data and facts collected from the companies involved and also from their competitors, customers and suppliers. Many talks are held with market players, questionnaires are devised for surveys and information is gathered; internal corporate documents are evaluated, sometimes economic analyses are carried out, external studies are consulted and – where useful – the companies’ premises are visited etc.

What is a “relevant market”

A key issue in assessing a merger project is to identify the markets specifically affected by the merger, the “relevant markets”. What are the products or services that form a market and that are in competition with each other?

It is necessary to define the market both in terms of the products or services offered and in terms of the territory covered. For this purpose, it has to be asked what alternatives are available to customers or suppliers to substitute the products or services in question with other products or services (so-called demand-side substitutability).

Example: Examination of the merger between the department store chains Kaufhof and Karstadt in 2018

Product market from the consumers’ point of view: There is no single department store market, but a variety of product groups (toys, sports/outdoors, home textiles, office supplies and stationery, etc.) have to be taken into account. The conditions of competition are very different in each of these product groups. There are different local shopping alternatives available for the various groups of goods. In addition, online sales also have to be taken into account.

Geographic market from the consumers’ point of view: With regard to offline sales, the market is not defined as national in scope. Instead, there are a number of individual regional markets, depending on the catchment areas of the department stores. Online sales, however, are to be considered as nationwide.

Concluding a proceeding

If a merger threatens to impede effective competition, it must be prohibited. Potential impediments to competition can to some extent be eliminated through commitments undertaken by the companies. For example, a company can be obliged to sell certain parts of the company or certain business divisions to competitors.

Clearance – The vast majority of notified mergers do not raise any competition concerns and can be cleared.

Prohibition – A merger which would significantly impede effective competition, in particular a merger which is expected to create or strengthen a company’s dominant position, is to be prohibited. Not every company that is large or economically strong is also dominant within the meaning of competition law. A company is dominant if it has no competitors on a market or is not exposed to any substantial competition or has a paramount market position in relation to its competitors.

It is not possible to prohibit a merger based on the assumption that it would impede competition on a so-called minor market. A market is minor if the total sales volume in the relevant market was less than 20 million euros in the year preceding the merger. If the conditions for prohibiting a merger are fulfilled in more than one minor market at the same time, the threshold of 20 million euros applies to all of these markets as a whole.

Clearance subject to remedies – The Bundeskartellamt may also clear a merger subject to conditions or obligations. The companies involved are then required to prevent an impediment to competition, which would otherwise be likely to occur. Examples of such conditions include the obligation to sell certain parts of the business or stores to an independent third party or to grant third parties certain access rights, frequency usage rights or patents to safeguard competition.

Legal protection and ministerial authorisation

The companies involved (in some cases also third parties that are affected by the merger) may appeal merger control decisions of the Bundeskartellamt to the Düsseldorf Higher Regional Court. Appeals on points of law against decisions of the Higher Regional Court can be lodged with the Federal Court of Justice in Karlsruhe.

In addition, German competition law provides for the possibility to apply for ministerial authorisation. The Federal Minister for Economic Affairs and Climate Action may authorise a merger prohibited by the Bundeskartellamt if in a specific case the negative effects on competition are outweighed by advantages to the economy as a whole or by overriding public interest. This possibility of having the Bundeskartellamt’s decisions, which are based on purely competition-related criteria, reviewed by political decision-makers in specific cases has proven effective in practice. Since the introduction of merger control in 1973, only ten applications for ministerial authorisation have been approved (seven subject to conditions). The decisions were based on various grounds such as, for example, ensuring energy supply, international competitiveness, safeguarding jobs or retaining valuable technical expertise.

Example: Edeka/Kaiser’s Tengelmann

In spring 2015 the Bundeskartellamt prohibited EDEKA’s plans to acquire 451 Kaiser’s Tengelmann stores. The authority held that the acquisition would significantly worsen the conditions of competition on the food retail markets. In the Bundeskartellamt’s view, consumers’ options to select and switch to other local food retailers would be substantially limited in some regions in Germany. Conditions for suppliers were also likely to worsen significantly since after the acquisition of Kaiser’s Tengelmann an important independent buyer would no longer remain as a sales alternative to the large retail chains. The Düsseldorf Higher Regional Court confirmed the Bundeskartellamt’s decision. In parallel to the judicial appeal the parties had also filed an application for ministerial authorisation. In March 2016 Sigmar Gabriel, the Federal Minister for Economic Affairs at the time, granted the authorisation subject to conditions in order to protect approx. 16,000 jobs at Kaiser’s Tengelmann.

Merger control in figures

-

804

... mergers were notified to the Bundeskartellamt in 2023.

-

6

... second-phase proceedings were concluded in 2023.

-

160

... days was the average duration of second-phase proceedings in 2023.